Main Thesis

Welcome to System Failure!

Introduction

My name is Nathan. As a sacrifice to the sinister god of compound interest, I was tossed into a financial volcano: I still owe $60k in student debt at age 40—even after more than a decade of on-time $1,200 monthly payments. My quest to re-achieve the “milestone” of zero net worth is still less than half-over. Trying to make sense of this senseless financial predicament propelled me on a journey deep into the history books and out onto the streets of Athens, Florence, Rome, and Prague.

What I found was nothing less than the Holy Grail itself. It shattered my pessimistic worldview, so now I want to share that discovery with you…

Chapter 1: Jubilee

Pre-Greek and Roman societies had a tradition that prevented anyone from falling into irrecoverable debt like I did. It was known as the “Jubilee”. Kings of ancient Assyria and Babylon canceled the personal debts of all their subjects at regular intervals. They did this because citizens who fall hopelessly into debt become dangerous and unruly, having no further incentive to play by society’s rules. Meanwhile, on the other side of the ledger, citizens who become too rich invariably try to seize the throne for themselves. The kings of the ancient Near East nipped both problems cleanly in the bud by periodically wiping the financial slate clean. This practical limitation on wealth and debt (two sides of the same coin) was accepted as common sense because it made those societies stable over the long haul.

Then democracy was born in Athens and soon adopted in Rome, and the Greco-Roman world rejoiced at having representation in the political process. But under democracy, there was no king with the power to cut rich creditors down to size or rescue underwater debtors. Absent any check on private fortunes, a few wealthy families claimed most of Rome’s economic pie for themselves. That lack of equitability was papered over by constant growth: as long as the economic pie kept expanding, the fortunes of the rich and the crumbs of the poor both could both grow together in tandem. But once Rome reached the limits of her expansion, the rich could only realize growth by taking it from the poor. Wealth inequality spiraled out of control and Roman society was doomed.

Chapter 2: Jesus

But there was one guy living during the twilight of Rome who saw the collapse coming. At his debut sermon from his hometown of Nazareth, Jesus waved an old Hebrew scroll in the faces of his disciples and boldly proclaimed the debt jubilee.

How did Jesus come to know about debt jubilees?

In an episode known as the “Babylonian Captivity”, Nebuchadnezzar sacked Jerusalem and carried its Jewish population off to Babylon as slaves. The Persian army later returned the favor by taking over Babylon. Their king, Darius, freed the Jews and sent them back home to rebuild Jerusalem. There, they re-consecrated the Temple of Solomon (where the Knights Templar would later be said to recover the Holy Grail) and finalized the set of documents we now know as the Hebrew Bible or the Old Testament. Recognizing the importance of the debt jubilee they learned about in Babylon, the Jews baked that notion into their scripture, where Jesus found it 500 years later.

In many languages, like Hebrew and German, there aren't separate words for “sin” and “debt”. The Gospel of Saint John could just as easily have been rendered in English as “forgive them their debts'' instead of “forgive them their sins''. Words like “forgiveness”, “redemption”, “armageddon”, and “salvation” are all perfectly intelligible in a financial context. This casts Christianity in a whole new light.

Chapter 3: Dionysus

John’s is the gospel in which Jesus turns water into wine. Whole chunks of that text are ripped straight out of The Bacchae—an old Greek play about the wine god Dionysus. A god who, according to his legend, dies and is resurrected. And who is symbolized by the kantharos cup (here you should be getting some more Holy Grail vibes).

What’s the deal with all this wine?

Back in the day, wine was like today’s pizza: a delivery system for other ingredients. At the same time the gospels were being laid down, a man named Dioscorides wrote out an extensive list of all the medicinal effects of every known plant. It took up five volumes. He slapped the name De materia medica on it, and the resulting “pharmacopoeia” was considered definitive all the way up until the time of the Renaissance. What interests us is that Dioscorides devoted the ENTIRE fifth volume to wine combined with other ingredients. Groovy ingredients like the hallucinogenic mandrake root. The ancient Greeks didn’t drink their wine straight-up. Dioscorides shows us that they regarded it as a mixer for potions of eyebrow-raising potency. These potions—not the contents of the Franzia box in your fridge— is what our friend Dionysus was the god of.

The New Testament was originally written in Greek, and the Gospel of Saint John is a tale with key words and scenes lifted straight out of a famous Greek play about a resurrected god of intoxication. When Greek-speaking people living around the Mediterranean theater caught wind of that, they must have rubbed their hands together with glee…because John’s gospel was telling them that they were about to get some kind of high.

Chapter 4: Eleusis

The rites performed at a place called Eleusis were central to the religious lives of the ruling classes of both Greece and Rome. For thousands of years, everybody who was anybody paid a visit to this small town just outside of Athens. From Plato right on up to Julius Caesar, the crème de la crème of the Greco-Roman world were initiated into something called the Eleusinian mysteries. It could not have been a bigger deal; blabbing this mysterious secret was punishable by death.

But then Athens became the world’s very first democracy, and the idea that the famed Eleusinian mysteries should be reserved for society’s upper crust fell out of vogue. It was replaced by the notion that all citizens are politically equal. In a democratic society, it was only a matter of time before the secret was democratized. And when it was, the cult of Dionysus became the populist counterpart to the rites at Eleusis.

Chapter 5: Ergot

So what was in the mysterious potions being served up in ceremonial chalices at Eleusis and mixed in with the wine drank by the frenzied revelers of Dionysus? That’s been an enduring mystery for thousands of years. But the most exciting part of Brian’s Muraresku’s 2020 book, The Immortality Key, is some remarkable new evidence from the burgeoning field of archaeobotany. At a site in Spain where Greek colonists once performed copycat Eleusinian mystery rites, a human jawbone and a ceremonial chalice both tested positive for ergot.

Ergot is a fungus that grows on cereal grains. It’s a magic mushroom. The wildly hallucinogenic ergot is thought to be responsible for causing some of the most bizarre episodes in history, like the Salem Witch Trials. It’s the very fungus that the Swiss chemist Albert Hoffman used to first synthesize LSD back in the 1930s. It’s also highly toxic. Ergot poisoning was known as “Saint Anthony’s Fire” during the Middle Ages because it’s excruciatingly painful and often fatal. The secret of Eleusis was apparently the knowledge of how to mix up an ergot potion so that it brought on beatific visions—without condemning the initiate to an agonizing death. For thousands of years this ancient piece of biotechnology was handed down from generation to generation of Eleusinian priestesses. But in the end, the democratization of the Athenian state led to the democratization of the secret of Eleusis—under the guise of the wine god Dionysus.

Chapter 6: Ego

Alcohol disables the part of your brain that makes you nervous. That’s why it’s called “liquid courage”. So fortified, you can give a better wedding toast or make a better overture to that cute girl at the bar. Even though it lowers cognitive function, booze can be a performance-enhancing drug. This pharmacological addition-by-subtraction also works on other parts of the brain. There are substances out there that shut off the ego in the way alcohol shuts off nerves. We call them psychedelics. And intoxication from those substances was at the core of all the major Greco-Roman religions, including Christianity.

Your ego is your mental conception of yourself. As a subjective observer, you triangulate on external objects by focusing your eyes. When I ask you to focus on yourself, you can only mirror this triangular pattern and interpolate backwards to a reverse focal point behind your eyes. This gives rise to the uncanny feeling that you are riding around inside your head, looking out through your eyes like some kind of windshield. That inverted focal point feels like the seat of your consciousness. It feels like you.

In the physical world, of course, there is nothing behind your eyes but brain meat. But you are not your brain, you HAVE a brain. Your parents didn’t name your brain. They didn’t name your body either. They named this spot behind your eyes and acted like that spot HAS a body. Though it’s the most useful of fictions, your ego is entirely a construct within your mind. It’s just the mental reflection of your physical body. You walk around all day behaving as if this reflection is really you, but it’s actually just a phantom. You are no more your ego than you are your reflection in the mirror.

So what happens when your ego is temporarily dissolved?

You are “lifted up out of the delusion of individuality”. You stop seeing yourself as a single person. Instead, you seem to be a progression of people. Like waves lapping at a shoreline, instead of a single wave. Drug-induced ego death (and, later, resurrection after the drugs wear off) brings on this wholesale shift in perspective every time. It’s like taking off a mask you forgot you were wearing. You identify as your ancestors and your descendants all at once. The importance of family suddenly snaps into focus and you feel a swelling desire to sacrifice on behalf of others. Because truly, if you go back enough generations, we are all family. The words "do unto others as you would have them do unto you" from the Sermon on the Mount become a self-evident tautology. This shift in perspective is what the Greeks and Romans meant by being “saved” at Eleusis. Intoxication was at the crux of it. You survive your own death by simply redefining what “you” are. Immortality comes from identifying as a progression of people instead of a single individual.

Chapter 7: Persecution

In 186 BC, the Roman senate outlawed the Dionysian cult and 6,000 cultists were put to death. The elite realized that religious practices involving drugs were a threat to their power. Think about it: the state can control individuals through torture and murder, but it has nothing with which to intimidate people who don’t see themselves as individuals. In an act of consummate badassery, Jesus demonstrated this concept by volunteering to have his body destroyed in a gruesome public spectacle.

To fight back against persecution, the cultists switched the sign on their door from Dionysus to Jesus. The Gospel of Saint John was their coded message. That story of death, salvation, and resurrection let Greek-speaking people in every corner of the Mediterranean know that the pirate flag was being raised. They moved their wild outdoor observances inside, away from the prying eyes. The consumption of drug-laced wine and ergot-infested bread became a sacramental meal. A meal that lives on in the Latin church as the “Last Supper” (the last meal before ego death). In the Orthodox church, it’s the “Mystical Supper” and to the Russians it’s the “Secret Supper”.

So it was that Christianity inherited the Dionysian elements—including the notion of a magic cup, of resurrection, salvation, and of surviving death. These are all major themes in every Christian church to this day. But the intoxication bit, the part that gives rise to these insights in the first place, was covered up in a dastardly coup by the elites.

Chapter 8: The Fall of Rome

That cover-up goes back to the twilight of the Roman Empire. The economic structure of Rome doomed her to an eventual debt collapse. On the eve of the Fall of Rome, the gap between rich and poor widened into a hopeless chasm. The upstart Christian faith exploded in popularity under those circumstances. It was, after all, a Greek intoxication cult grafted onto the apocalyptic Jewish anti-rich, anti-debt tradition. To the exhausted subjects of the dying empire, a more attractive bouquet of religious ideas can hardly be imagined.

When the end came and the Visigoths pounded at the gates of the Eternal City, the Roman elite dressed up as Christians to save their hides. They adopted Christianity as their state religion, and the Bible was edited and formalized into a state-sanctioned document. Because of its sly and indirect allusions to The Bacchae and to drug-use, the Gospel of Saint John slid into the finalized version. The Gospel of Thomas, on the other hand, didn’t make the final cut of the Bible because it was too explicit about Jesus and drugs:

Selected Verses from the Gospel of Thomas

1 And he said, "Whoever discovers the interpretation of these sayings will not taste death."

13 And Jesus said to his disciples, "Compare me to something and tell me what I am like." Simon Peter said to him, "You are like a just angel." Matthew said to him, "You are like a wise philosopher." Thomas said to him, "Teacher, my mouth is utterly unable to say ”

Jesus said, "I am not your teacher. Because you have drunk, you have become intoxicated from the bubbling spring that I have tended."

108 Jesus said, "Whoever drinks from my mouth will become like me; I myself shall become that person, and the hidden things will be revealed.”

To preserve their wealth, the newly fused church and state re-branded the debt forgiveness demanded by Jesus into forgiveness in the afterlife. To preserve their power, they replaced the ego-dissolving drugs with a Eucharist of regular bread and wine. They sought a monopoly on access to heaven; they couldn’t have people accessing the divine with mushrooms that any fool could pluck in the forest. In short, they un-democratized the mysteries.

Chapter 9: Christianity

Even though intoxication was formally edited out of Christianity, everyone knew that visionary drugs had been at the core of that religion. They didn’t forget overnight. It wasn’t until the time of the Inquisition, a thousand years later, that the Church even began pretending it hadn't originally been all about getting high. That's why, according to Julie and Jerry Brown, you can still find mushrooms in medieval art throughout Christendom:

Chapter 10: Drugs

Today, visionary drugs like mushrooms and LSD have reentered our culture. But they are still demonized by the powers-that-be. Our version of the Roman Senate, the US Congress, has classified these substances as “Schedule I”. That means they supposedly have “no currently accepted medical use and a high potential for abuse” and that possessing them is a felony. Research out of Johns Hopkins and NYU hints at their awesome religious power and makes nonsense of this legislation. But of course, the fight over these drugs has always been about political power. The competitive hoarding of wealth—for the glorification of individual egos—once brought mighty Rome to its knees. And now that same disease is rotting our modern society.

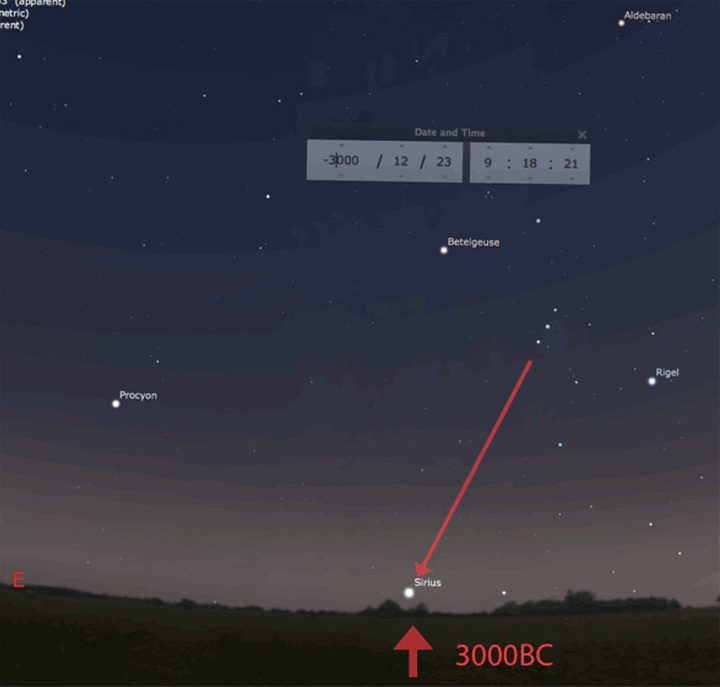

Chapter 11: Jesus & The Sun

The tale of Jesus is really an allegory for the sun. This fact is hidden in plain sight on Presbyterian crosses, like the one pictured below. We’ve all seen these crosses—they’re the ones with circles behind them. They look like the crosshairs of gun sights. But circles whacked up into 4 pie slices have been around much longer than Christianity. This is the age-old symbol of the sun; the circle symbolizes a year divided into 4 seasons. It’s a simple and obvious way to represent a single annual cycle of the sun in the sky. The stroke of an ancient pen elongated the lower arm of the cross, converting that ancient sun symbol into a ubiquitous Christian icon.

Chapter 12: The Number Twelve

The number 12 has always been associated with the sun. And so it was associated with Jesus too. The reason Jesus has 12 disciples is the same reason the zodiac has 12 signs. It’s the same reason that there are 12 months in a year. Or that there are 12 hours that repeat twice daily. In fact, the word “hour” comes from the name of that old sun god, Horus, from dynastic Egypt. Our words “horizon” and “horoscope” also bear this guys’ name. All this just goes to show how much the sun figures into our conception of time.

We visualize the passage of time on a circle like the one behind the Presbyterian cross; think of a circular clock face. Clocks are laid out the way they are because they’re derived from the sun dials of old. On a clock face, the 12 hours are arranged around the perimeter just like they were on ancient sundials. The sun always comes with its 12 disciples.

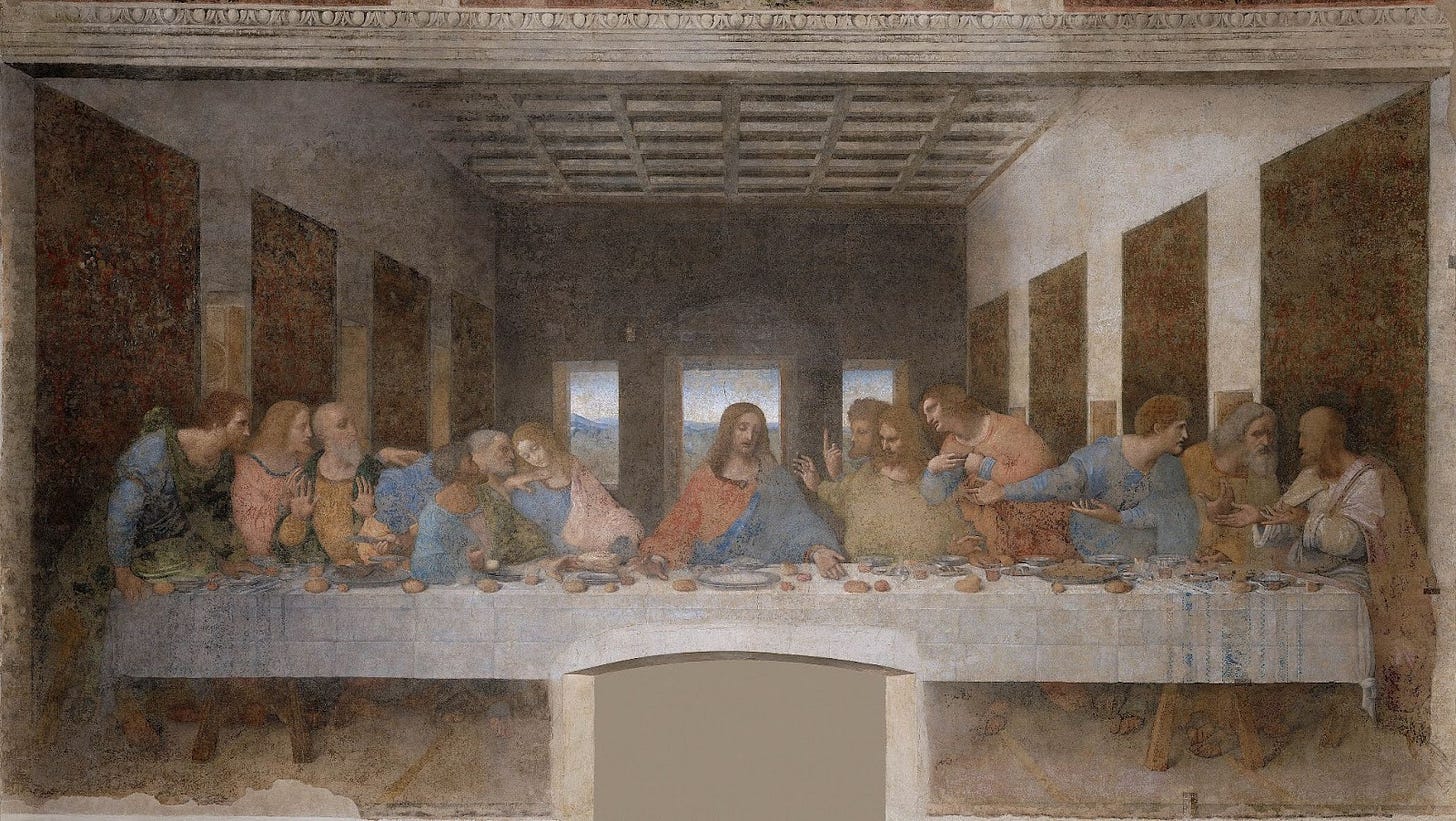

Chapter 13: Da Vinci

Leonardo Da Vinci understood that the Jesus story was a retelling of the old sun god myth. That’s why, when it came time to paint his Last Supper mural, he laid it out as an astrological allegory. Da Vinci took care to cluster his 12 disciples into 4 groups of 3, evoking the seasons of the year in the same way the Presbyterian Cross does. Once you see it, it can’t be unseen. The Jesus legend is as much about the sun and the passage of time as anything else.

Chapter 14: The Sky

It was clear to the ancients, from gaping at the sky, that we live out our lives inside a cosmic system of perpetual death and rebirth. That’s why sun gods are always said to have been resurrected. The sun seems to die each evening when it sets and to be born again each dawn.

In addition to this daily cycle, there’s also an annual cycle. During the autumn, the sun gradually disappears from the sky as the days get shorter and colder. Until the winter solstice—that’s when the sun reverses course and gradually starts coming back. The days get longer, the weather warms back up, and the spring flowers bloom. This cycle is why sun gods are always said to be born on December 25th. The winter solstice is when the new year is born. That date was the birthday of the Egyptian Horus, the Greek Helios, the Persian Mithras, and the Roman Sol Invitcus. And of course Jesus Christ, too, was born on Christmas.

Chapter 15: Calculus

Sir Isaac Newton, a man who emulated Jesus by remaining a virgin until the day he died, was also born on December 25th. Newton was an odd guy, to say the least. He was most likely somewhere on the autism spectrum. He was also a genius, a noted alchemist, and a man who was keenly interested in time. So interested, in fact, that he invented a little thing called calculus.

Calculus is the math of rates—and rates of rates. It gives us a peek behind the stage curtain of reality. A key notion is that time and distance are really the same thing. Measuring with a stopwatch versus measuring with a ruler feel like totally different experiences. But saying that it’s 150 miles to Boston or that it’s 2 hours to Boston are actually two ways of relaying the exact same piece of information. Time is the same kind of measurement as length, width, and height. Calculus winks at us. It hints that reality is really some kind of multi-dimensional manifold which our brains interpret as a story with a beginning, middle, and end.

Chapter 16: Time & Money

Calculus concerns itself with compound rates. Distance over time is speed, for example, and changes in speed over time we call acceleration. Another compound rate is money over time. That’s finance. Think about it: financial institutions are in the business of distributing future money in the present. That’s their function in society. When you need to borrow money to buy a house or start a business, you visit a bank. And that bank sells you your own money from the future. Having all the cash at the beginning of the Monopoly game, as they do, means they can set up a toll booth on access to our future money. The toll they charge is the interest on the loans they make. This practice of charging interest was vehemently opposed by Jesus and forbidden by the church all the way up until the time of the Renaissance.

Chapter 17: Time & Ego

There is also a connection between time and ego. To understand how time fits into the picture, imagine a cluster of broccoli. The main stem of the broccoli divides into many smaller stems. So if you chop your broccoli near the florets, you get a cross-section of many small stems. But if you chop it on the other end, you get a cross-section of only a few stem. If you slice it at the stalk, you’re looking at a cross-section of only the main stem. The number of stems you see in these cross-sections depends entirely on where you choose to take your 2D slice. Only in the fullness of 3 dimensions are those apparently individual stems revealed to be a part of one continuous whole. In exactly the same way, all us humans share a common ancestor somewhere in the distant past. Our apparent existence as individuals is an illusion caused by the way we perceive time.

Chapter 18: Salvation

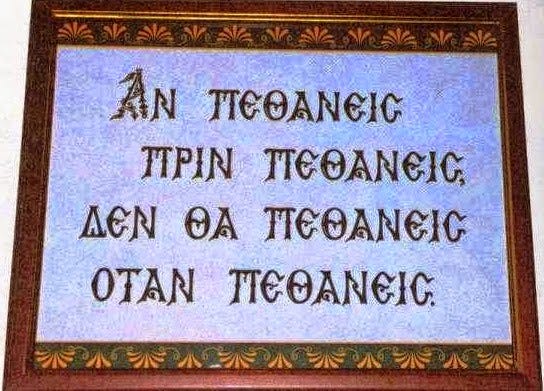

The insight that individuality is an illusion has always been pharmacologically available. Your ego is just your mental conception of yourself. The ancient Greeks and Romans would temporarily shut off the part of the brain that gives rise to the ego by making use of naturally-occurring psychoactive compounds. That experience feels like death and rebirth. They called the experience “salvation” and interpreted the loss of ego as immortality. Surviving your own death is a simple matter of changing your conception of what “you” are. The Greeks put it this way:

Chapter 19: Death & Rebirth

At the time the Roman government took over the church, the psychoactive drugs were phased out. The state always wants people associating with their bodies as closely as possible. That’s because it’s the only part of us they can get their hands on. If people stop identifying as their bodies, the state has a real control problem on its hands. At the end of the Jesus tale, he allows the state to publicly destroy his body and forgives them in advance for doing it. That’s a pretty dicey message for the Roman government to be endorsing; it’s easy to see why the drugs had to go.

Besides the control problem, access to god is a lucrative business. The Roman church couldn’t have people finding god by eating plants readily available in the forest. Monopolies are very profitable (just ask the financial gatekeepers who charge us a toll to access our future money). The delusion of individuality does a lot of heavy-lifting for the powers that be. But death-and-rebirth is how we escape that delusion.

Worship of the sun is really the worship of that part of us that transcends time and individuality; that part of us that identifies as a species—or as a progression of beings—instead of as individuals. And Christianity is ultimately about that too. It’s not that the legends of Jesus and the other sun gods are literally true. They’re more true than that. They’re hyper-true—like a skeleton key that fits many locks instead of just one. And the central theme of Christianity, redemption via death-and-rebirth, is broadly applicable:

Chapter 20: The Holy Grail

The Holy Grail is, of course, a symbol. That much seems uncontroversial. But what is it a symbol of? In his 2003 thriller The Da Vinci Code, Dan Brown suggests that it symbolizes the bloodline of Jesus Christ in the person of his wife, Mary Magdalene—that it’s a symbol for the lost idea of the sacred feminine. The Da Vinci Code is one hell of a read, but Brown was only flirting with the real truth about the grail. In reality, the feminine symbol of the magic cup goes back much further than Christianity.

The Holy Grail represents a shocking realization: that we are much more than the individual people we appear to ourselves to be. We are, in fact, progressions of people. So much of what we are is handed down to us from our parents and passed on to our children. We are a series of waves lapping at a shoreline, more than we are any single one of those individual waves.

There are many ways of getting at this fundamental truth. You can fast for weeks on end. Or meditate alone in a cave every day for years. Or you can have a child. You can transcend time and individuality by creating a copy of yourself, and watching that copy act out your own life again as it carries your strengths and weaknesses into the future. Just as your parents watched you do the same with their strengths and weaknesses. And hopefully you live to watch that child have children of its own and repeat the process again. This insight that comes from the transcendence of time and individuality is available to all genders, but it is especially poignant for women, who feel their bodies—previously experienced as a single individual—divide itself into two or more such individuals. That’s why the secret of the Grail has always been characterized as feminine. That’s why Da Vinci painted his Mona Lisa with that famous sly smile. And that’s what Dan Brown picked up on in The Da Vinci Code.

Brown also suggests that the Roman church stamped out the notion that Jesus might have had a wife and a child; that Mary Magdalene was recast as a common whore after it was taken over by the Roman government. Power wants us to think of ourselves as individuals. They control us by threatening our individual bodies with torture and imprisonment. Or, in today’s modern age, they sell us stuff by exacerbating the illusion of individuality. Buying behavior can be reliably induced by making us feel inadequate or insecure as individuals. Or by making us feel we need to consume to keep up with the Joneses. The egoic forces of temporal power are always suppressing the secret of the Grail because they want us to believe that we are individuals. All their power rests on us believing that illusion. That’s why The Da Vinci Code is a tale of underground societies, puzzles, and secret symbols.

The force that opposes the egoic accumulation of power and wealth might be called love. It’s the other side of the equation. It’s the thing that makes parents sacrifice for their children. It makes heroes sacrifice for their communities, in defiance of their apparent individuality. As we will see, all of history is an external manifestation of an internal struggle that takes place inside the minds of each and every one of us. This is the animating force behind the grand drama of humankind. The secret of the Holy Grail, in other words, is much older than Christianity…

Chapter 21: Greece & Rome

In addition to fasting or meditating or having children, the insight that we are more than mere individuals is available by pharmacological means. Certain plants in the forest contain psychoactive compounds that temporarily dissolve the ego. These drugs lay bare the reality that we are all a progression of people, much more than we are individual people. They work by inducing an actual experience to this effect.

That’s why the pre-Christian religions of classical Greece and Rome featured magic cups. Literal magic potions, made of those psychoactive compounds, were being drunk by the Greeks and Roman in the centuries leading up to the advent of Christianity. This is where the imagery of the Grail comes from. In the case of the grain goddess Demeter, there was a magical Kykeon. Historian Will Durant wrote that pilgrims visiting the temple of Demeter at Eleusis “broke their fast by participating in a holy communion” and were “lifted up out of the delusion of individuality”. Durant was writing about Eleusis back in the 1930s. But it was not until 2002 that a vessel used during the rites of Demeter tested positive for ergot, a magic mushroom. It now appears that the mystical Kykeon of Demeter was actually some kind of ergotized beer. All members of the Greek and Roman upper classes were initiated into these mysteries of Demeter, from Plato right on up to Julius Caesar. The same Greek people who formalized the anti-egoic notion of democracy were ritualistically dissolving their egos. It’s not a coincidence. And that’s always been the point of democracy: joint decision-making cancels out the effect of any one person’s ego. Bottom-up decision-making stands in stark contrast to the top-down decision making that characterizes early civilization. History is the ongoing story of the human struggle to make that polar shift.

The mirror image, among common people, of the elite cult of Demeter was the wildly popular cult of Dionysus. This god of wine and intoxication arrived very late into the pantheon of Greek gods. Like Demeter, death and rebirth was a major theme of this resurrected god. And of course, his chief symbol was the Kantharos cup. Inevitably, he was resisted by the religious authorities (who were also the state authorities in those days). But such was his popularity that they had to begrudgingly accept him into Greek mythology. Dionysus’ conquest of the Greek state religion foreshadowed Christianity’s conquest of Rome. After all, the power of love—or the secret of the Holy Grail—is the animating force behind history. And history shows us that state power always loses out in the end.

The earliest human societies were downright sociopathic. One individual held all the power, and that person got to act out their ego at the expense of everyone else. Accordingly, the Roman Empire was an ethical disaster; the entire thing was built on the backs of slaves. A powerful few glorified their egos to extravagant excess—while the vast majority spent lifetimes toiling on their behalf. Those primitive human societies were structured without any regard to what life was like for most citizens. But whispers of the Holy Grail could be heard in the shadows, preparing to confront and conquer the seemingly insurmountable might of Rome.

In 186 BC, the Roman government violently cracked down the worship of Dionysus and his magical wine. Naturally, the senate saw that intoxication cult as a threat to its power. So they ordered thousands of cultists put to death. But the secret insight that we now know as the Holy Grail would not go away. Instead, it simply changed forms. The communion of the grain goddess Demeter, symbolized by wheat or bread, and the communion of the wine god Dionysus were rolled up into a brand new religion: Christianity.

The authorities, as we’ve mentioned, have a real control problem on their hands when people stop identifying with their individual bodies. Jesus demonstrated this by volunteering to have his body destroyed. Truly, the Romans knew not what they did. That gruesome public spectacle unleashed the driving force of history. The Roman authorities tried dusting off the tired old persecution playbook that they had used to combat the cult of Dionysus. But the acolytes of Jesus seemed positively delighted to be fed to lions in the Colosseum. Within 300 years of the crucifixion, the Roman Emperor himself bent the knee and accepted baptism into the church of Jesus.

Chapter 22: The Middle Ages

In the end, the exploitative slave society that was Rome collapsed. It had to: it was predicated on constant expansion to remain stable. When Caesar wept for there were no more lands to conquer, the clock began ticking ominously on the Empire. The Roman authorities tried to save themselves from mounting disaster by dressing up as Christians. And once they had taken over, they banned the magical sacraments of Demeter and Dionysus that were living on as the Christian sacrament. As the early church became the Roman church, the magical potions of antiquity became ordinary bread and wine. The Roman church demonized women who knew the secrets of all the plants in the forest; they were recast as witches. The church sought a monopoly on access to God; they couldn’t have people glimpsing the divine by plucking plants growing freely in the woods. But those who understood the feminine secret of psychedelics kept the faith alive. They shielded it from the authorities by referring to it as a magic cup. This is where our friend Dan Brown picked up the plot.

Eventually, the Fall of Rome gave way to a Medieval society. The medieval economy was stagnant, rather than being predicated on infinite growth like the Roman one had been. Counter-intuitively, conditions actually improved for the average Joe. Peasants typically worked three days for themselves, three days for their feudal lord, and then on Sunday they sat in church and heard about how this arrangement was ordained by God. “Since medieval agriculture was no less efficient than ancient agriculture” wrote David Graeber, “the amount of work required to feed a handful of mounted warriors and clergymen could not possibly have been anything like that required to feed entire cities. However oppressed medieval serfs might have been, their plight was nothing compared with that of their Axial Age equivalents.” Feudal society bridged the gap between the slave societies of antiquity and the modern states of today. The master-slave relationship evolved into a lord-serf relationship.

Chapter 23: The Renaissance

The evolution from the lord-serf economy of the Middle Ages to our modern employer-employee paradigm was every bit as rocky as the Fall of Rome. As the Roman church became blatantly corrupt and self-serving, its authority began to wane. A revolution in communications technology–the printing press— was underway at that time. People printed up Bibles in common languages and circulated them far and wide using the new-fangled presses. They no longer had to take the church’s word on the Latin translation, and they were appalled by what they found in the Good Book. “It revealed” wrote Will Durant “ the communism of the Apostles, the sympathy of Christ for the poor and oppressed; in these respects the New Testament was for the radicals of this age a veritable Communist Manifesto.” Actual scripture, it turned out, stood in stark contrast to the church’s shameless amassing of great wealth by selling forgiveness of sin.

Matters deteriorated even further when the Black Death arrived in Europe. The clergy seemed to die of the plague at the same rate as everybody else. It's supposed monopoly on access to heaven— established by persecuting women in the know about psychedelics—was exposed as a total fraud.

Chapter 24: The Knights Templar

The final nail in the church’s coffin came from, of all places, the banking houses that sprung up in Europe in the wake of the crusades. The Knights Templar operated the first of these banks. A pilgrim on the road to Jerusalem could visit the Temple Church (which still stands today on Fleet Street in London) and exchange coinage for a letter of credit. Those letters of credit could then be redeemed elsewhere in Christendom for coins again. This prevented pilgrims from having to carry large sums of money on the dangerous road to the Holy Land, which was rife with bandits.

The Knights Templar amassed so much wealth that the Church began to view them as a threat. In 1307, Pope Clement V (at the behest of King Philip of France, who had fallen hopelessly into debt to the them) sent out sealed orders to arrest the Templars and extract confessions from them through torture. They stood accused of the worst crimes imaginable like devil-worship, perversion, and pedophilia.

The only monarch who balked at the Pope’s orders was King Edward III of England. He hesitated for a few crucial months before finally bringing down the hammer on the Templars. But that head start allowed the knights to go underground and form the secret society we know today as the Freemasons. Here again we find secret societies connected to the Holy Grail. During the crusades, the Knights Templar were said to have discovered the grail underneath the old Temple of Solomon in Jerusalem. If history is a struggle between love and ego, then it is the ego that tends to control political power and material wealth. The ego seeks these things for its own glorification. Like the early Christians persecuted in Rome, the Templars resorted to grail symbology and secret societies to avoid being detected by the authorities.

Chapter 25. The Medicis

The Medicis of Florence ultimately succeeded where the Knights Templar had failed. They, too, ran a banking empire that amassed a fortune off the economic currents revived by the Crusades. And, just like the Templars, that soon brought them into conflict with the Vatican. But rather than being swallowed up by the church, the Medicis instead took it over. Just as the Roman emperor had done to the church as Rome collapsed and the Middle Ages dawned, several Medicis assumed the throne of St. Peter and became popes themselves.

The fascinating thing about the Medicis is that they craved access to the magical secrets of pre-Christian Greece and Rome. In their day, the Eastern Greek fragment of the old Roman Empire was finally succumbing to history. Gunpowder was deployed onto the battlefield for the first time, and the cannons of the Sultan demolished the walls of Constantinople. The chaos spread Greek scholars living there to the wind. Word had spread that the Medicis were looking for alternatives to the corruption of the Roman church, so many of these Greek scholars made their way to Florence. Their influence ignited a Medici fascination with pre-Christian Greco-Roman culture. And so it was that the massive Medici banking fortune was used to finance a revival of Greek and Roman philosophy and the study of Greco-Roman art. The result, of course, was the Italian Renaissance.

The other fascinating thing about the Medicis was that they were obsessed with magic, and kept bizarre collections of alchemical oddities. In fact, when Medici agents rustled up an old Greek manuscript about magic called the Corpus Hermeticum, Cosimo de’ Medici ordered a halt to the monumental translation of Plato. The old patriarch of the Medici clan was getting on in years, and he wanted a crack at the magic of hermeticism before he died. The story goes to show how the Medicis were concerned with magic above all else. In fact, the gardens outside the Medici palace in Florence are centered around statues of Demeter, our old friend from the mystery rites at Eleusis. The garden is a hedge maze laid out according to the notion of an alchemical journey (a journey through difficult times with a return home—like Homer’s Odyssey or the Divine Comedy by Florence’s own Dante). Like Dan Brown, they were dancing all around the psychedelic secret of Greco-Roman religion but never figured it out. That discovery would have to wait until the 20th century.

Chapter 26: Capitalism

The Medici obsession with magic eventually brought us modern science. Alchemy morphed into chemistry. Astrology became astronomy. And a science-driven shift in perspective—that the earth orbits the sun and not vice-versa—finally destroyed the last vestiges of authority the Roman church had left. Science seized that baton of authority and used the scientific method to create the technology that drove the Industrial Revolution. A new era of rapid economic growth dawned. And of course, this rapid growth was financed by banking houses with their compound interest schemes. That is the final legacy of the Medicis of Florence.

The lord-serf economic arrangement that prevailed during the Middle Ages gave way to the employee-employer relationship we all live with today. And it was another massive improvement, just as the advance from master-slave to lord-serf had been a vast improvement for the common person. But our modern nexus of banking and scientific institutions is predicated on infinite growth, just as the Roman economy was. Horrifyingly, that means that it is doomed to an eventual Rome-like collapse. That’s why so many people today have the feeling in their gut that we are going over the falls in a barrel once again.

Chapter 27: Karl Marx

The prophecy of Karl Marx was that it is a historical certainty that the employer-employee arrangement will ultimately be destroyed by the same technology that gave rise to it. And with chaos undeniably mounting 100 years later, it certainly looks like Marx’s prophecy is about to come true.

It is interesting to notice how Marx’s work is treated as heresy. The McCarthy Era of the 1950s shares a historical symmetry with burning of heretics by the Christian church during the Middle Ages. One thing is for sure: it is very odd how, given the undeniable splash his writing made on history, that one can progress through the upper echelons of higher learning without ever being required to read a word of it.

Perhaps that’s because Marx’s work emphasizes the community over the egoic individual. Over the arc of history, we’ve watched democracy conquer every facet of public life. But individual control over the apparatus of production and distribution has proven to be the toughest nut to crack. That’s the final frontier in the polar shift from top-down to bottom-up control, from despotism to democracy, that is the story of history. And one thing is for sure: power never exits the stage in a dignified manner. It has to be hauled off kicking and screaming.

Chapter 28: Collapse

Two of the major themes of the Renaissance are with us once again during this transitional period. A new revolution in communications technology, the internet, is exposing the malfeasance of our ruling elite. Cell phone cameras are showing the world the realities of law enforcement. Twitter accounts document the shameless insider trading of our politicians, just as the printing press once exposed the corruption of the Roman church. And no matter which side of the COVID debate you come down on, we can all agree that the response to it from our own authorities has been as woefully inadequate as the church’s response to the Black Death. It was a trip walking the streets of Florence during the recent pandemic and seeing the public, once again, wearing plague masks.

Christianity started as a scrappy revolt against the Roman imperium. But it had lapsed into a wheezing disgrace by the time the Renaissance rolled around. That’s when our modern banking-science nexus arose heroically to replace it. These systems have life cycles. They arise well-suited to certain circumstances, but then those circumstances change as history marches on. The trajectories of Roman slave society and Christian feudal society show us that the sun will also set on our modern capitalist society. As the Greek philosopher Heraclitus once remarked, “there is nothing permanent except change.”

A third eerie tie-in with the Renaissance is that of the paradigmatic shift. The discovery that the Earth orbits the sun—and not the other way around—was a stunning inversion of the reality people thought they were living in. The authority of the church never recovered from that discovery.

Science took over from the church and crowned itself arbiter of reality. It assures us, like the church used to, that we are insignificant creatures moving around inside a grand creation. But science has painted itself into a corner. The double-slit experiment and the placebo/nocebo effects are undeniable evidence that we are not mere observers of reality. We are also creating it. Just like in our dreams, which we simultaneously create and experience. The universe is actually within our minds, rather than our minds being within the universe. This is the next reality inversion that’s brewing. And it will be one hell of a shock for anyone assuming all our paradigm shifts are already behind us.

That’s the lesson of the Corpus Hermeticum. That ancient magical text, so coveted by Cosimo de’ Medici, suggests that we are God’s co-creators: “If then you do not make yourself equal to God you cannot apprehend God; for like is known by like. Leap clear of all that is corporeal”. That notion, the basis for all magical thinking, was declared a heresy by a church that had been hijacked by the egoic political power of a dying Roman Empire. It wanted people playing the role of repentant servant before a master with absolute authority.

That’s also the great lesson of psychedelics. The reality we thought we were living in is like reflection in a still pond on a calm day. Psychedelics are like dropping a rock into that pond. The ripples distort the previously perfect image and betray it for what it is: a mere reflection and not reality itself.

Now, in the 21st Century, the magical secrets of ego-destroying drugs have finally reentered society. Like the Medicis of Florence, who delved into the ancient past, the time has come for humanity to complete our alchemical journey by returning home. Our Holy Grail is the lost knowledge that we are not individuals bound by time. Rather, we are timeless progressions of people. Our journey through history—through master-slave, lord-serf, and employer-employee—has been long and painful. But now the time has come to complete our Grail quest and find out what comes next…

Sources:

A Distant Mirror by Barbara Tuchman

Debt: The First 5,000 Years by David Graeber

...and Forgive Them Their Debts by Michael Hudson

The Collapse of Antiquity by Michael Hudson

The Immortality Key by Brian Muraresku

The Food of the Gods by Terence McKenna

Behold A Pale Horse by William Cooper

The Life of Greece by Will Durant

Caesar and Christ by Will Durant

The Age of Faith by Will Durant

The Renaissance by Will Durant

The Reformation by Will Durant

I also personally traveled to Athens, Crete, Florence, Rome, and Prague in 2021-2023 researching this stuff.

"So what happens when your ego is ... dissolved?

You are "lifted up out of the delusion of individuality"."

There is a very interesting parallel from the theory of monetary economics. Usually, interest is considered as a source of income, which is designed to increase the wealth of those who have enough money anyway. Vast quantities of investment advisers and other figures are engaged in convincing people to "invest" their earned money in any investments, so that those who have brokered the conclusion can henceforth earn a low-performing income. So here the ego of one is abused in order to feed the ego of the other. Whether it is unfair or not, it should be stated here that the decisive factor here is that money is used as a means of individual business activity, i.e. the ego defines the idea that exists about money, which then also determines the treatment and use of money. The results that a desolidarized society (the consequence of the ego) produces can now be viewed in a well-known country.

Now, of course, there is also a different point of view. "The practice of charging interest was vehemently opposed by Jesus and forbidden by the church all the way up until the time of the Renaissance." Now Jesus was not a money theorist, but was probably more oriented to the practice of the jubilee years, which were necessary to avoid the over-indebtedness of entire sections of the population. So it's easy to get the idea to ban the cause of it completely right away. This may have been correct against the background of the monetary system of the time, but that should not be of further interest here.

Rather, it is crucial that today the monetary system is linked to debt relationships, which ideally have a social character. This character arose with the Industrial Revolution and the associated need to finance labor (where capital ist nothing more than labor done in advance). The basic figure is that the financing of labor requires the sale of the product in order to recoup the costs of the product - plus an unfunded entrepreneur's wage. In a FIAT money system, all you need for financing is banks, because they can finance any project with the support of the Central Bank - if necessary also with the help of a consortium. It is important to understand that it is the debts incurred that lead entrepreneurs to sell produced goods for a practically worthless money - the legend that money is a right to goods has never been true.

Now banks find their justification for existence in the fact that they, as lenders, enable the investment volume that keeps an economy running. Since banks operate in a money economy environment, they - like all other companies - have to keep an eye on covering the costs with the current income. However, the depreciation from failed loans has the same effect as costs, as they reduce the annual profit in the income statement as well as personnel and material costs. The risk premium is therefore equivalent to an insurance premium that works analogously to the known risk insurances. With car insurance as the most well-known risk insurance, it is the case that the amount of the damage amount per year determines the amount of the premiums: if the damages increase, the premiums increase, the damages decrease, the premiums decrease. This pattern can be found in the banking industry, where the pattern looks like that in the case of positive expectations for the future (= low depreciation losses), interest rates have a tendency to decrease, while in economically difficult times (= high depreciation losses), bank interest rates have a tendency to increase, although from an economic theory point of view, just the opposite - namely, interest rate cuts - is considered necessary to "boost" the economy again.

Since banks now operate with the money issued by the Central Bank, there is no justification in itself for the fact that they receive an interest as an income element for money, but can only claim a risk premium that compensates for the default of loans. Then, for example, it is no longer justifiable for banks to charge a market interest rate for real estate financing, because the risk of loss default is largely eliminated by the collateral provided by the property and thus, from a risk point of view, a market interest rate is not justified. Perhaps one of the reasons for the broad-based campaign to declare banks as the "creators of money" is that it could turn out that charging a market interest rate will result in a non-performing income and their position as "benefactors" of society could be questioned. If people would understand that it is the central Bank from which the money comes, the popular reference to the "investors", who would have to be compensated for it, would also disappear. With money from the Central Bank, these claims are no more than lukewarm air.

All this means that money, understood as a medium of the social organization of production, is not a means to individually achieve a low-performing income, but to contribute to the sustainability of the provision of social services to ensure the survival of society over time. Once people have understood this, interest is a means to remove credit claims that are no longer faced by a productive project from the overall context of the debt relationships. By the way, the sole function of interest as risk compensation also prevents the accumulation of monetary assets, the disastrous effect of which was already clear to our ancestors thousands of years ago.

Money does not exist to service individual fortune but to secure the continuation of society over time. Unfortunately, this knowledge has been lost, but there is always the possibility to exhume it again.

Hi Nathan. I tried posting a response to your comment on the Webb article, but it didn't go through. Worried they connected my two addresses.